ASK THE EXPERTS: When is the best time to get a practice valuation?

A: The best time to get a certified practice valuation for your wealth management business depends on your specific circumstances.

However, it may be beneficial to consider getting one:

- Before a sale or merger: This helps to determine the value of your business for negotiations and helps ensure a fair deal.

- During strategic planning: A valuation can provide valuable insights into your business’s strengths and weaknesses, allowing you to make informed decisions.

- At the end of a fiscal year: A yearly valuation provides a snapshot of the value of your business at a specific point in time.

Financial advisors should obtain a valuation regularly because various changing aspects of their practice affect the valuation, including:

This valuation should identify the drivers of growth for the practice so as to maximize the value of the practice at the time of actual succession.

- Aging population of financial advisors – According to Cerulli Associates, about 43% of financial advisors are at or close to retirement age. For financial advisors moving closer to retirement age, a well-defined succession plan should include an external valuation of the practice.

Changing demographics of clients – With Baby Boomers quickly moving into retirement, the assets under management of financial advisors may stagnate and erode. Most of the growth in assets has been and will likely continue to come from the assets of new clients.

Recognizing this demographic change, reviewing and understanding the practice’s client base and the impact of this demographic shift on revenue is important to maintaining and improving practice valuations.

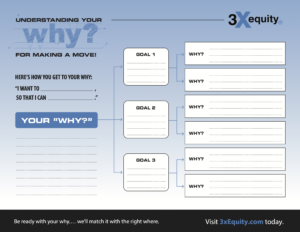

Complete the form here to get started