- Money Matters

- The Numbers Behind Going independent

- Benefits and Costs of Breaking Free

Chances are, at one point or another over the course of your career, you’ve pondered the idea of breaking away from the wirehouse. After all, the thought of going independent can be an exhilarating, albeit intimidating, idea — more control… more money… more responsibilities!

There are a number of key factors to consider when deciding on whether you should make a big change. One of the biggest factors that advisors want to know about is the money. How does their compensation change? What can they except in extra costs that were typically covered by the wirehouse? What kind of impact does this have on their retirement plans?

Compensation concerns?

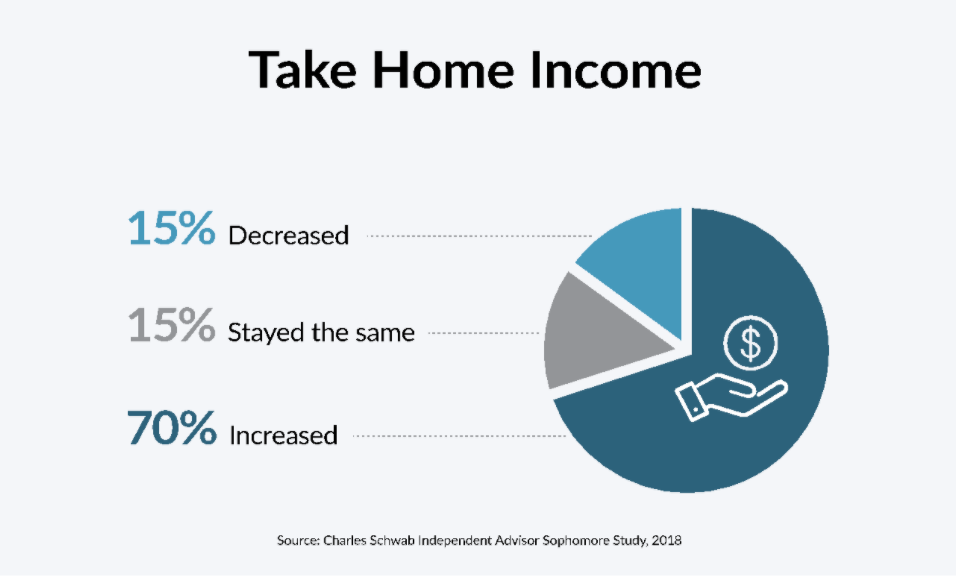

With the increased costs and the possibility of losing clients, it’s no surprise that advisors can be hesitant towards breaking free and going independent. But, it’s time to quell those fears, because 85% of advisors who broke free reported that they found no decrease in their compensation when they went independent.

What’s your piece of the pie?

Advisors working at a wirehouse typically find their average payout is between 35%-52%. Making the move to independence can see that average payout increase as much as 50%, and in some cases slightly more. It’s no wonder making the big move to independence is always on advisors’ minds.

What’s the give and take?

In the case of going independent, give comes in the way of operational costs and responsibilities that are typically covered by the wirehouse. As you find yourself in the independent space, you now must tackle the challenges of keeping your business up and running. You have to make sure that your team has the equipment and technology they need to go about their business day in and day out, and it’s up to you to provide the marketing materials and activities needed to help keep your business growing.

What’s the end game?

Despite the additional costs that may come with going independent, the big move also comes with a huge potential payday down the line when it’s time to retire. A major benefit to being an independent advisor is that you own your book of business. Period. Looking at the end game, owning your book of business means you have more opportunities with succession planning when it comes to cashing out. Bottom line, you get a bigger payday in comparison to what you would get if you were to sunset at a wirehouse.

What’s an advisor to do?

Breaking free from a wirehouse is not a decision to take lightly. It comes with its pros and cons… freedoms and responsibilities. It’s up to you to decide if the benefits of independence outweigh the costs — and it’s our job to help you make sense of it all and guide you. So take that first step with 3xEquity. After all, you know what’s best for your business and your clients, and we can provide you with the insight and real offers needed to make an informed decision.

We’re built to help you throughout the entire transition process, providing you with up-to-date data, serving as your sounding board, and helping you negotiate the best transition package possible. Click here to partner with 3xEquity today.